Investing in commercial real estate is considered a wise decision in the current market for several reasons. It typically offers higher potential income than residential real estate.

Commercial properties generally have longer lease terms, which can provide investors with a more stable and predictable income stream. Additionally, the value of commercial properties tends to appreciate over time, offering the possibility of significant capital gains.

With current low-interest rates, borrowing for investments is more affordable, making it an ideal time to invest. Furthermore, commercial real estate often counters inflation, as property values and rents usually rise with it.

Lastly, owning commercial property can offer tax benefits, including deductions for property depreciation, maintenance, and operating expenses. All these factors combine to make commercial real estate a compelling option for investors seeking long-term, stable, and potentially lucrative investments.

How Do You Assess the Value of Commercial Real Estate?

Assessing the value of commercial real estate involves several key factors. The income approach is commonly used, where the property’s potential income is calculated and compared to the investment needed.

This includes analyzing rent rolls, occupancy rates, and the net operating income (NOI). The market approach is also vital, involving comparing the property to similar properties that have recently sold in the area.

This comparison helps in understanding the market demand and the price per square foot or unit. Additionally, the cost approach can be considered, which estimates the cost to replace the property, taking into account depreciation.

Factors like location, property condition, and the current real estate market trends also play a crucial role. Overall, a comprehensive analysis combining these approaches provides a realistic valuation of commercial real estate.

Globally, the commercial real estate industry is expected to expand by 3.03% between 2023 and 2028, reaching a market size of US$133.50 trillion by that year.

Challenges of Commercial Real Estate Investment

Investing in commercial real estate presents several challenges:

- Market Fluctuations: Commercial real estate markets can be volatile, with values and demand subject to economic cycles.

- High Initial Investment: Typically requires a substantial initial outlay compared to residential real estate.

- Complex Financing: Securing loans for commercial properties is often more complicated and stringent.

- Longer Vacancy Periods: Commercial properties can remain unoccupied for longer periods, impacting cash flow.

- Maintenance and Upkeep Costs: Often higher than residential properties, especially for larger commercial buildings.

- Property Management Challenges: Requires more intensive management, including dealing with multiple tenants and lease negotiations.

- Regulatory and Zoning Issues: Navigating complex zoning laws and compliance regulations can be challenging.

Overcoming Commercial Real Estate Investment Challenges

To effectively overcome challenges in commercial real estate investment, consider the following strategies:

- In-depth Market Analysis: Conduct thorough research on market trends, demographic shifts, and economic forecasts to make informed decisions.

- Diversification: Spread your investments across various types of commercial properties and geographical locations to mitigate risk.

- Robust Financial Planning: Ensure you have adequate financial resources and a solid plan for both initial investment and ongoing expenses.

- Professional Networking: Build relationships with industry experts, including real estate agents, brokers, financial advisors, and legal professionals for guidance and support.

- Effective Property Management: Implement efficient management strategies or hire professional property managers to handle daily operations and tenant relations.

- Risk Management: Identify potential risks and have strategies in place to address them, including insurance and contingency funds.

How to Identify Emerging Markets for Commercial Real Estate Investments?

Identifying emerging markets for commercial real estate investments involves research and strategic analysis. Key steps include analyzing economic trends, such as areas with growing employment rates, increasing population, and expanding industries, as these factors often signal a rising demand for commercial spaces.

Analyzing market data like vacancy rates, rent trends, and property values, along with tracking infrastructure developments, is key to identifying growth potential in a region for businesses.

Furthermore, networking with local real estate professionals and attending industry events can provide insider insights into emerging markets. Keeping an eye on government policies and business incentives can also point toward markets poised for growth.

Ultimately, a market showing signs of economic vitality and development, combined with favorable real estate trends, is a promising candidate for commercial real estate investment.

Difference Between Commercial Real Estate and Residential Real Estate

The differences between commercial and residential real estate are significant, each catering to distinct market needs and investment strategies:

Aspect | Commercial Real Estate | Residential Real Estate |

Property Types | Offices, retail spaces, and industrial buildings. | Homes, apartments, condos. |

Investment Size | Larger initial investment. | Smaller initial investment. |

Lease Terms | Longer (5-10 years). | Shorter (1-2 years). |

Income Potential | is Higher, but variable. | Lower, but more stable. |

Market Sensitivity | is High to economic changes. | More stable, less sensitive. |

Financing | Complex with larger down payments. | Simpler, and more accessible. |

Management | Intensive, professional management is needed. | Easier, often personal management. |

Regulations | More complex legal issues | Simpler, more standardized. |

Why Location Matters More in Commercial Real Estate?

Location is a critical factor in commercial real estate due to its direct impact on accessibility, visibility, and profitability. A prime location ensures easy access for customers, employees, and suppliers, which is essential for retail, office, or industrial spaces.

High-traffic areas or those with good transportation links typically see more customer footfall, leading to higher sales and business visibility. Additionally, location influences the type of tenants attracted to the property and their willingness to pay premium rents.

Properties in thriving business districts or near major amenities often command higher rents and have lower vacancy rates. Moreover, the location determines the long-term appreciation potential of the property, as areas with strong economic growth, and urban planning tend to increase in value over time.

Thus, in commercial real estate, a strategic location not only drives immediate operational success but also significantly impacts the long-term investment return.

In 2021, the global commercial real estate market was valued at around 34 trillion U.S. dollars, a figure nearly double the size of China’s economy.

Why Do You Prefer Residential Real Estate to Investment?

Preferring residential real estate investment can be attributed to several key factors. It’s often more accessible for individual investors due to lower entry costs compared to commercial real estate.

Residential properties also tend to offer more straightforward financing options, making it easier for new investors to enter the market. The demand for housing is perennial and less susceptible to economic downturns, providing a stable investment.

Additionally, residential real estate can yield steady rental income and the potential for long-term property value appreciation. It’s also more flexible, allowing investors to choose from various types of properties, such as single-family homes, apartments, or multi-unit buildings.

Moreover, tax benefits such as deductions on mortgage interest, property taxes, and maintenance expenses enhance its attractiveness. Finally, for many investors, the tangibility and familiarity of residential properties, make it a preferred choice over commercial investments.

7 Key Aspects of Residential Real Estate

Key aspects of residential real estate include:

- Property Types: Includes single-family homes, apartments, condos, townhouses, and multi-family units.

- Market Stability: Generally more stable than commercial real estate, with constant demand due to housing needs.

- Investment Accessibility: Lower entry barriers in terms of cost and financing compared to commercial real estate.

- Management Requirements: Involves property maintenance, tenant management, and adherence to residential zoning laws.

- Liquidity: Typically, residential properties are more liquid than commercial properties and easier to sell or rent.

- Location Importance: Proximity to amenities, schools, and transportation significantly impacts property value and desirability.

- Market Sensitivity: Influenced by economic factors, interest rates, and local housing market conditions.

How to Effective Your Residential Real Estate in the Present Market?

To effectively market residential real estate in the current market, a multifaceted approach is essential. Understanding the local market trends and pricing properties competitively is crucial.

High-quality, professional photography and virtual tours have become indispensable for showcasing properties appealingly. Leveraging online platforms, including real estate websites, social media, and digital advertising, is vital for reaching a broader audience.

Personalized email marketing campaigns can help keep potential buyers engaged. Staging the property to enhance its appeal and holding open houses, while adhering to any health and safety guidelines, can attract more interest.

Finally, networking with other real estate professionals and utilizing word-of-mouth can also be effective. Being adaptable and responsive to market changes, including shifting buyer preferences and tech advances, is key to success in the current real estate landscape.

Luxury Real Estate: Is it Worth the Investment?

Investing in luxury real estate can be highly worthwhile, though it comes with unique considerations. Luxury properties often offer greater potential for appreciation due to their exclusivity and limited availability.

These high-end properties tend to be more resilient to market fluctuations, maintaining value even during economic downturns. The luxury market also appeals to a niche clientele, including high-net-worth individuals and international buyers, who are less price-sensitive, making these properties a stable investment choice.

Additionally, luxury real estate can provide substantial rental yields if leased out, especially in sought-after locations. However, it’s important to note that luxury properties require significant initial capital and can have higher ongoing maintenance costs.

Moreover, the luxury market can be less liquid, meaning properties may take longer to sell. Therefore, while luxury real estate can be a solid investment, it requires thorough market knowledge, careful financial planning, and a long-term investment perspective.

How Should You Invest in Luxury Real Estate?

Investing in luxury real estate requires a strategic approach tailored to the unique characteristics of this market segment:

- Conduct Thorough Market Research: Understand the trends and demands specific to the luxury real estate market in your desired location.

- Evaluate Financial Capacity: Ensure you have the financial resources for the substantial investment and maintenance costs associated with luxury properties.

- Focus on Prime Locations: Invest in areas known for their exclusivity, scenic views, or prestige, as location is a key determinant of luxury property value.

- Look for Unique Features: Seek properties with distinctive characteristics, such as custom architecture, historical significance, or state-of-the-art amenities.

- Seek Expert Advice: Consult with real estate professionals who specialize in the luxury market for insights and guidance.

- Consider Long-Term Investment: Luxury real estate often requires a long-term perspective for significant appreciation.

Why is Maintaining Privacy Essential in Luxury Real Estate?

Maintaining privacy is crucial in luxury real estate due to the preferences of high-net-worth individuals who often make up the buyer and seller market in this segment. These clients typically seek discretion for security reasons and to protect their personal and professional lives.

High-profile individuals, including celebrities and business executives, value their privacy highly and choose properties that offer seclusion and confidentiality. Moreover, privacy in transactions is essential to prevent inflating property prices or causing unwanted public attention.

In the marketing and sale of luxury properties, exclusive listings and private viewings are common practices to maintain this privacy. Additionally, maintaining privacy is important in safeguarding the financial details and negotiation terms of high-value transactions.

Thus, in luxury real estate, privacy is not just a preference but a fundamental aspect that guides how transactions are conducted, properties are marketed, and client relationships are managed.

The size of the commercial real estate market is expected to expand to several million USD by 2030. This growth represents an unanticipated Compound Annual Growth Rate (CAGR) from 2022 to 2030, compared to its status in 2022.

How Should You Select a Commercial Property Investment?

Selecting a commercial property investment requires a strategic approach that balances financial goals with market research. Start by defining your investment objectives, whether it’s long-term appreciation, immediate cash flow, or diversification of your portfolio.

Location is crucial; seek areas with strong economic growth, low vacancy rates, and potential for future development. Consider the type of commercial property that aligns with your goals, be it retail, office, industrial, or multi-family units.

Analyze the property’s financial performance, including rental income, occupancy rates, and operating expenses. Don’t overlook due diligence; inspect the physical condition of the property, review leases, and understand zoning laws.

Lastly, assess the risks involved, such as market fluctuations and tenant turnover, and consider potential exit strategies. Making an informed decision involves a blend of thorough market analysis, financial acumen, and an understanding of real estate dynamics.

Tenant Retention Important in Commercial Property

Tenant retention is crucial in commercial property management for several reasons:

- Stable Revenue Stream: Retained tenants ensure a consistent income, reducing the unpredictability associated with finding new tenants.

- Lower Turnover Costs: Minimizing tenant turnover reduces costs related to marketing, tenant improvements, and leasing commissions.

- Enhanced Property Value: Properties with long-term, stable tenants are often valued higher due to their steady income generation.

- Reduced Vacancy Rates: Consistent tenant occupancy maintains a healthy occupancy rate, making the property more attractive to investors and lenders.

- Positive Reputation: A high tenant retention rate can enhance the property’s reputation, making it more appealing to prospective tenants.

- Stronger Relationships: Building good relationships with tenants can lead to easier negotiations and renewals.

Why Is Commercial Property Important for Revenue Growth?

Commercial property plays a crucial role in revenue growth due to its potential for higher and more stable returns compared to other investment types. These properties include retail spaces, office buildings, and industrial facilities.

Additionally, commercial leases often include annual rent increases and pass-through clauses for maintenance and operational costs, shifting some financial responsibilities to tenants and thereby reducing the owner’s expenses.

The higher rental rates associated with commercial properties also contribute to a more substantial revenue stream. Over time, commercial properties generally appreciate, offering the potential for capital gains upon resale.

Furthermore, owning commercial real estate diversifies an investment portfolio, mitigating risk and potentially enhancing overall financial performance. Commercial property is key to revenue growth due to its steady income, potential value, and investment portfolio diversification.

In 2022, commercial real estate transactions amounted to $1.14 trillion, a decrease from the $1.43 trillion recorded in 2021.

Why Raw Land Development Can Be a Profitable Path?

Raw land development can be a highly profitable venture due to several factors. Raw land is often more affordable than developed property, offering a lower entry cost for investors. This undeveloped land presents a blank canvas, allowing for a wide range of development possibilities, tailored to the specific demands and growth patterns of the area.

Additionally, urban expansion and strategic location can significantly increase the value of raw land, which, when developed, transforms from a passive asset into a profitable venture through construction, leasing, or selling.

Moreover, developing raw land allows for creative control and the opportunity to implement sustainable and innovative building practices, which can attract modern tenants and buyers, further enhancing profitability.

However, it’s important to note that raw land development requires thorough market research, careful planning, and a clear understanding of zoning laws and regulations. The profitability of raw land development hinges on strategic selection, effective planning, and efficient execution.

Common Infrastructure Requirements for Raw Land Development

Developing raw land requires addressing several key infrastructure requirements to ensure functionality, compliance, and appeal. These common requirements include

- Access Roads and Transportation: Construction of roads and pathways to ensure access and connectivity to the development site.

- Utility Setup: Installation of essential services like water supply, sewage systems, electricity, and gas connections.

- Drainage and Stormwater Management: Implementing effective drainage systems to prevent flooding and manage water runoff.

- Telecommunications Infrastructure: Establishing internet, telephone, and other communication services connections.

- Street Lighting: Installing lighting for safety and visibility, particularly in public and communal areas.

- Sidewalks and Pedestrian Pathways: Creating safe pedestrian walking areas and enhancing accessibility.

From 2023 to 2028, the US land development market is expected to experience growth. The industry has seen a Compound Annual Growth Rate (CAGR) of 4.3% over the previous five years, culminating in an estimated revenue of $9.4 billion in 2023.

How to Secure Necessary Permits for Raw Land Development?

To secure necessary permits for raw land development, start by understanding local zoning laws and building codes through consultations with municipal planning departments. Prepare a detailed development plan with professional input from architects, engineers, and surveyors.

Submit this plan along with required applications to local authorities for review, which may involve assessments for environmental compliance and community impact. Attend any necessary public hearings.

Once the plan meets all regulatory standards and public concerns are addressed, the relevant permits will be issued. This process requires thorough preparation, adherence to local regulations, and effective communication with authorities.

Profit Margin Returns for Raw Land Development

Here’s a hypothetical table showing profit margin returns for raw land development, including probability ranges and raw amounts:

Development Stage | Probability Range (%) | Hypothetical Amounts ($) |

Purchase Cost | Low: 5-10 | 100,000 |

Development Cost | Medium: 15-25 | 200,000 |

Selling Price | High: 30-40 | 400,000 |

Gross Profit | – | 400,000 |

Profit Margin | – | 25% |

How Can You Identify Profitable Crowdfunding Investment Opportunities?

Identifying profitable crowdfunding investment opportunities requires a combination of research, due diligence, and an understanding of market trends. Start by thoroughly researching the project or business seeking funding.

Look into the background and track record of the team behind the project, ensuring they have the necessary skills and experience. Evaluate the business plan for viability and scalability, focusing on the uniqueness of the product or service, target market, and revenue model.

Also, consider the level of community and investor engagement, as a strong, supportive community can be a good indicator of a project’s potential success. It’s important to assess the risks involved, including market risks, and the project’s stage of development.

Additionally, keep an eye on market trends, as they often present promising opportunities. However, remember that all investments carry risks, and crowdfunding investments are no exception. Diversification across multiple projects can help mitigate these risks.

Is Crowdfunding Investment an Effective Option for Long-Term?

Certainly, here’s a concise summary of key points regarding the effectiveness of crowdfunding investment for long-term goals:

- High Risk, High Reward: Crowdfunding investments, particularly in startups, can offer high returns but come with significant risks, including the potential loss of the entire investment.

- Diversification: It can diversify a portfolio but should be balanced with more stable, traditional investments.

- Illiquidity: Crowdfunding investments are often illiquid, meaning funds may be tied up for a long period with no guarantee of return.

- Regulatory Landscape: The evolving regulatory environment can impact long-term investment viability.

- Due Diligence Required: Success in crowdfunding investment relies on thorough research and understanding of each opportunity.

- Impact Investment: Crowdfunding allows for investment in social and environmental causes, aligning with the goals of impact investors.

- Long-Term Viability: While offering growth potential, it’s uncertain as a sole strategy for long-term investment due to its inherent risks and volatility.

Are There Ethical Considerations in Crowdfunding Investment?

Yes, there are several ethical considerations in crowdfunding investment, both for investors and project creators. These include

- Transparency and Honesty: Project creators must provide clear, accurate, and honest information about their projects. Misleading investors or failing to disclose important information can be ethically problematic.

- Use of Funds: Ethical issues arise if funds are not used as promised. Investors expect their contributions to be used for the stated purposes.

- Fair Treatment of Investors: Projects should treat all investors fairly, regardless of the amount they invest. This includes equitable distribution of rewards, profits, or acknowledgments.

- Accountability and Reporting: Regular updates and transparent reporting on the progress and use of funds are crucial. Lack of accountability can lead to mistrust and ethical concerns.

- Social Responsibility: Crowdfunding projects often have a social impact. Ethical considerations include the project’s impact on communities, the environment, and society at large.

In the U.S., the equity crowdfunding market saw its annual total funds raised increase from $25 million in 2013 to $272 million by 2022.

How to Evaluate High-Yield Cash Flow Investments?

Evaluating high-yield cash flow investments requires a careful analysis to balance potential returns against associated risks. Assess the stability and reliability of the income stream. This involves examining the track record of earnings and the predictability of future cash flows.

For real estate investments, prioritize location, occupancy rates, and tenant quality. For dividend stocks, focus on dividend history and earnings stability. Overall, ensure the entity’s financial health is strong, indicating an ability to sustain high yields.

Additionally, consider the market conditions and economic factors that could affect the investment’s performance. It’s also important to evaluate the investment’s liquidity and the ease with which you can convert it into cash.

Lastly, understand the tax implications of the investment, as taxes can significantly affect the net returns. By thoroughly analyzing these aspects, investors can make informed decisions about high-yield cash flow investments.

Does Economic Downturn Impact Cash Flow Investment?

Yes, an economic downturn can have a significant impact on cash flow investments:

- Real Estate: During a downturn, property values may decrease, and vacancy rates can increase, reducing rental income and affecting the cash flow from real estate investments.

- Dividend Stocks: Companies may cut dividends during economic hardships to conserve cash, impacting investors who rely on dividend income.

- Business Investments: Businesses might face reduced revenues and profits, affecting their ability to generate positive cash flow and pay returns to investors.

- Loan Repayments: In debt investments like peer-to-peer lending, borrowers may struggle to make repayments during a downturn, leading to defaults and reduced cash flow for investors.

- Interest Rates: Central banks often lower interest rates in a downturn to stimulate the economy, which can reduce the returns from fixed-income investments and savings accounts.

- Consumer Behavior: Economic slowdowns can lead to decreased consumer spending, affecting businesses across various sectors, and consequently impacting the cash flow generated from investments in these businesses.

How to Handle Tax Implications in Cash Flow Investments?

Handling tax implications in cash flow investments involves understanding relevant tax laws, including income tax on earnings, capital gains tax on property sales, and corporate taxes for business investments.

Consult with a tax professional to understand specific obligations and potential deductions or credits available, like depreciation for real estate. Keep meticulous records of all investment-related income and expenses, as this will be crucial for accurate tax filings.

Consider the timing of selling assets, as holding periods can affect capital gains tax rates. For retirement planning, explore tax-advantaged accounts, which can be used for certain cash flow investments.

Staying informed about changes in tax laws and regulations is also key, as these can impact the overall tax burden of your investments. Proper tax management can significantly affect the net return on cash flow investments.

Commercial Real Estate Myths: Is There Any Truth to Them?

The world of commercial real estate is rife with myths that can often mislead or confuse investors and professionals alike. One common myth is that commercial real estate is reserved for the ultra-wealthy or institutional investors, whereas in reality, many individuals and smaller investors successfully enter this market.

Another widespread belief is that commercial properties always guarantee high returns, overlooking the nuances of market dynamics, location, and property type. There’s also a misconception that commercial real estate is immune to market fluctuations, but like any investment, it is subject to economic cycles and can be affected by various external factors.

Debunking these myths is crucial for anyone looking to make informed decisions in this field. Understanding that commercial real estate requires due diligence, market research, and a realistic approach to risk and returns can lead to more successful investment strategies.

5 Tips for Successful Commercial Real Estate Investments

Successful commercial real estate investments hinge on a blend of market understanding, strategic planning, and prudent decision-making. Here are some key tips:

- Market Research: Thoroughly research the market to understand current trends, demand drivers, and future growth potential.

- Location Analysis: The location of a property significantly influences its value and potential for appreciation. Assess accessibility, local economy, and neighborhood dynamics.

- Diversification: Diversify your portfolio across different types of commercial properties (like office, retail, industrial) and geographical areas to mitigate risk.

- Financial Analysis: Conduct detailed financial analysis including cash flow projections, return on investment (ROI), and total cost of ownership.

- Risk Assessment: Understand the risks involved, including market volatility, tenant turnover, and regulatory changes.

Conclusion

Commercial real estate offers a dynamic and potentially lucrative investment opportunity. Success in this field requires thorough market research, strategic location selection, financial due diligence, and an understanding of the long-term nature of these investments.

Diversifying across property types and locations, assessing tenant quality, and staying informed about market trends and regulatory changes are crucial. Incorporating sustainability and leveraging professional advice and networks can further enhance prospects.

With careful planning and a keen eye on market dynamics, commercial real estate can be valuable to an investment portfolio.

FAQs

How can I finance a commercial real estate investment?

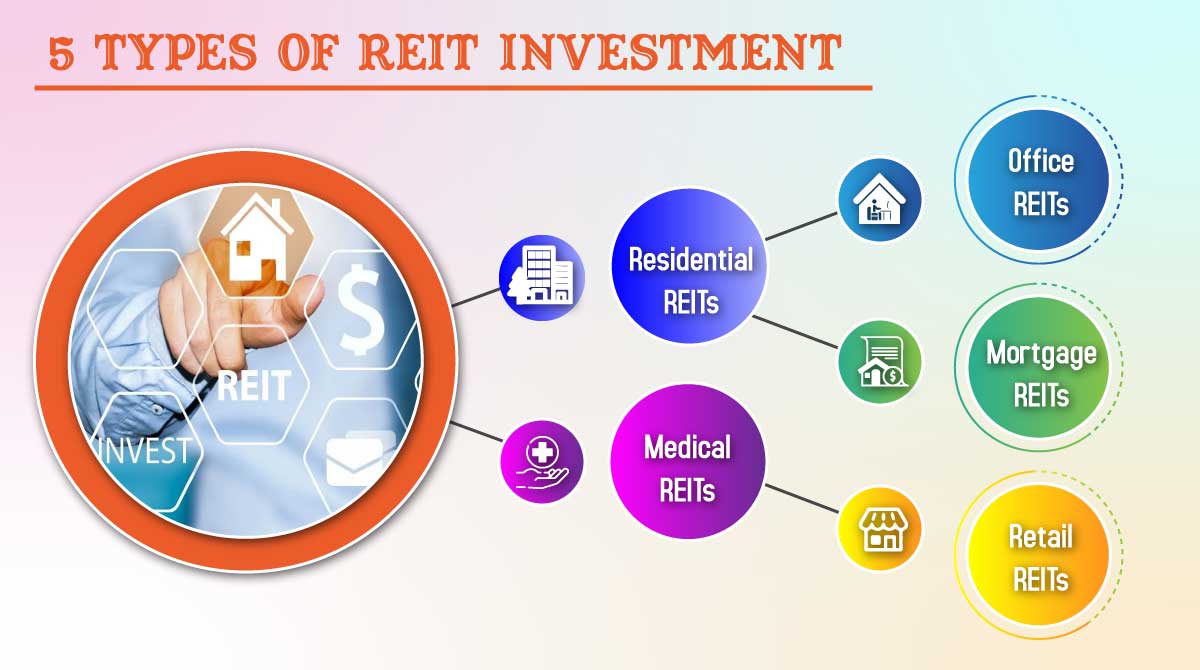

Financing options include traditional banks, commercial mortgages, real estate investment trusts (REITs), and private lenders. Terms and conditions vary widely based on the property type and the investor’s financial status.

How important are lease agreements in commercial real estate?

Lease agreements are crucial as they define the terms of the tenant’s occupancy, including rent, duration, responsibilities of both clients, and termination conditions. They directly impact the revenue and legal standing of the investment.

What are the risks involved in commercial real estate investment?

Risks include market volatility, changes in economic conditions, property-specific issues, tenant turnover, and changes in the regulatory environment. Proper due diligence and market analysis can help mitigate these risks.

How does economic climate affect commercial real estate?

The economic climate impacts CRE through factors like interest rates, consumer spending, business growth, and employment rates. Economic downturns can reduce demand and rental income, while a booming economy can enhance property values and occupancy rates.

Key factors to consider when investing in commercial real estate?

Important factors include location, property type, market conditions, tenant quality, lease terms, property condition, and potential for appreciation or rental income.