Real estate is still one of the best ways to build wealth, but let’s face it—it comes with risks. Market swings and economic changes can hit individual investors hard. That’s where professional investment services come in. Think of them as your safety net; they use their expertise and real-time data to spot trouble before it affects your wallet. This guide explores how having the right team in your corner can protect your investment and keep your portfolio steady, even in a shaky market.

Key Takeaways

- Risk Reduction: Investment services mitigate risk through professional tenant screening, regulatory compliance, and predictive market analysis.

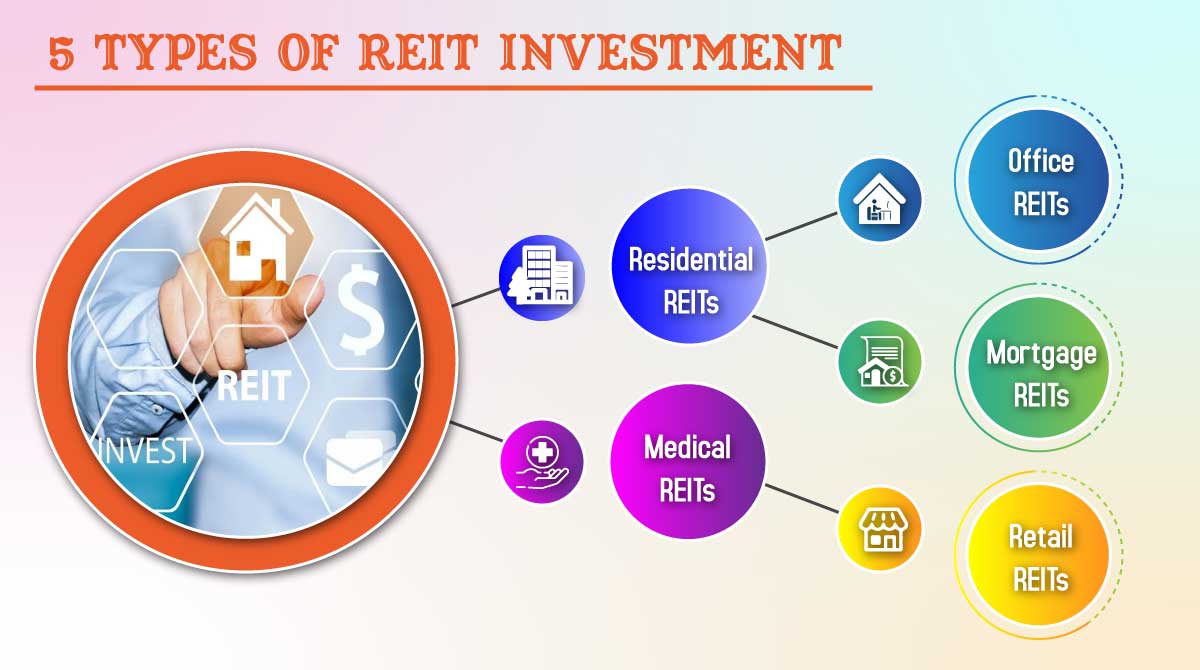

- Exclusive Access: Services often provide access to off-market deals and institutional-grade REITs not available to the general public.

- Cost vs. Value: While property management fees average 8-12%, the prevention of costly vacancies and legal disputes often outweighs the expense.

- Diversification: Professional services facilitate broader asset allocation across residential, commercial, and emerging markets.

Do Real Estate Investment Services Really Mitigate Risk?

Yes, real estate investment services significantly mitigate risk by applying professional expertise to market analysis, tenant management, and asset diversification. By utilizing advanced data analytics and legal frameworks, these services identify potential pitfalls—such as bad tenants or declining neighborhoods—before they impact your bottom line, effectively shielding your capital from common investing errors.

While property values can rise due to renovations or economic expansion, they can also plummet. Professional services bridge the gap between uncertainty and calculated strategy. They provide the due diligence that individual investors often lack the time or resources to conduct thoroughly.

How Do Real Estate Investment Services Reduce Risk?

Professional services utilize specific mechanisms to protect your investment. Here are the three primary methods:

1. Market Knowledge and Skill

Service providers possess deep insights into local real estate market trends, zoning laws, and valuation metrics.

- Predictive Analysis: They identify which neighborhoods are poised for growth and which are stagnating.

- Valuation Accuracy: They prevent overpaying for assets, ensuring you enter the market at a safe price point.

2. Strategic Risk Management

Risk is not just about market crashes; it is about operational failure. Services implement robust risk management strategies:

- Diversification: Spreading capital across different property types to buffer against sector-specific downturns.

- Exit Strategies: Planning clear liquidation paths before the asset is even purchased.

- Contingency Planning: Establishing reserve funds and insurance protocols for unforeseen disasters.

3. Access to Exclusive Opportunities

Public listings are often the most competitive and least profitable.

- Off-Market Deals: Access to properties before they hit the Multiple Listing Service (MLS).

- Institutional REITs: Opportunities to invest in large-scale Real Estate Investment Trusts (REITs) that offer liquidity and stability.

Data Insight: According to updated market analysis, the global real estate investment management market continues to expand, projected to exceed $22 billion by 2028, driven by a demand for risk-averse investment strategies.

What Are the Costs of Real Estate Investment Services?

The cost structure varies based on the level of service, location, and asset class. However, understanding the standard fee breakdown is essential for calculating ROI (Return on Investment).

Standard Property Management Fees:

Most firms charge a percentage of the monthly rent collected.

- Rate: Typically 8% to 12% of monthly rent.

- Example: For a property renting at $1,200/month, a 10% fee equals $120/month.

Service Fee Breakdown

Fee Type | Typical Cost | What It Covers |

Management Fee | 8-12% of Rent | Ongoing oversight, rent collection, tenant communication. |

Leasing Fee | 50-100% of 1st Month Rent | Advertising, tenant screening, lease drafting. |

Maintenance Markups | 10-20% over invoice | Coordination of repairs and contractor management. |

Vacancy Fee | Flat Fee (varies) | Costs incurred while the unit is empty (some firms waive this). |

Note: These fees are often tax-deductible, further mitigating the net cost to the investor.

How to Invest in Real Estate Safely (Step-by-Step)

Achieving long-term wealth requires a systematic approach. Follow this structured workflow to minimize exposure:

- Define Financial Objectives: Clearly establish your risk tolerance, time horizon (e.g., 5, 10, 20 years), and expected Cash on Cash Return.

- Conduct Market Research: Analyze macro-economic factors (employment rates) and micro-factors (school districts, crime rates) in your target region.

- Analyze the Asset: Before making an offer, evaluate the property’s condition, potential rental income (Cap Rate), and immediate renovation costs.

- Consult Professionals: Once an offer is accepted, engage a Real Estate Attorney or agent to handle closing documents and ensure clear title.

- Implement Management: Decide whether to self-manage or hire a property manager to handle tenant placement and rent collection.

- Monitor and Adjust: Regularly review asset performance. If a property underperforms, adjust rent, renovate, or divest to protect the portfolio.

5 Advantages of Real Estate Investment Services

Why should an investor pay for these services? The value proposition lies in efficiency and protection.

- Professional Expertise: Access to seasoned professionals who understand regulatory compliance and market cycles.

- Wider Access to Properties: Entry into “pocket listings” and high-value commercial assets unavailable to the general public.

- Portfolio Diversification: The ability to easily invest across residential, commercial, and industrial sectors to spread risk.

- Effective Property Management: Hands-off handling of the “Three Ts”: Tenants, Toilets, and Termites. This includes vetting and collections.

- Access to Financing: Investment firms often have relationships with private lenders and banks, offering better rates or commercial mortgage terms.

Real Estate Service Market Split

Understanding where service providers focus their energy helps you understand what you are primarily paying for. The chart below illustrates that the majority of firms focus heavily on leasing and maintenance activities, which are critical for risk control. (Note: Percentages exceed 100% as firms typically offer multiple overlapping services.)Most Common Services Offered by Investment Firms

Source: Industry Market Analysis Data

Myth: You Should Only Invest in City Properties

No, investing solely in city properties is not the only path to profit and can actually increase risk due to market saturation. While urban centers offer high visibility, they often suffer from compressed Cap Rates and high entry costs.

Conversely, suburban and “secondary market” areas are experiencing rapid growth as remote work trends stabilize.

- Competition: Urban cores are dominated by institutional investors, making it hard for individuals to compete.

- Growth Potential: Peripheral zones often offer higher appreciation potential as populations expand outward.

- Smart Strategy: Investors should look for regions with strong economic fundamentals, regardless of whether they are urban or suburban.

FAQ

- What is a real estate asset management firm?

A real estate asset management firm operates at a strategic level, focusing on maximizing the value of a property portfolio. Unlike property managers who handle day-to-day operations, asset managers handle macro-decisions like refinancing, major capital improvements, and divestment to ensure long-term appreciation.

- What distinguishes a Real Estate Trust from a REIT?

A REIT (Real Estate Investment Trust) is a company that owns or finances income-producing real estate and is traded publicly on stock exchanges like a stock. A Real Estate Fund is typically a mutual fund that invests in securities offered by public real estate companies, rather than buying the properties directly.

- Can you lose money in REITs?

Yes, like any equity investment, REITs carry risk. They are sensitive to interest rate hikes; as interest rates rise, the cost of borrowing increases for REITs, and safe assets like bonds become more attractive to investors, potentially driving down REIT share prices.