For startups, crowdfunding offers an alternative to traditional VC funding, allowing them to bypass gatekeepers and directly connect with a wider pool of potential backers. This opens doors for diverse and innovative ideas, often tackling social and environmental challenges, to get the funding they need.

Investors, on the other hand, are attracted by the democratization of investment. Crowdfunding platforms empower anyone, regardless of net worth, to become an investor and potentially reap the rewards of supporting exciting ventures.

Beyond the tangible benefits, crowdfunding fosters a sense of community and shared ownership. Investors feel connected to the companies they support, witnessing their journeys and celebrating their successes.

So, whether you’re an aspiring entrepreneur seeking a launchpad or a curious investor looking for exciting opportunities, crowdfunding could be the key you’ve been searching for. It’s a win-win proposition, democratizing finance, and building a more invested future for everyone.

Top 5 Crowdfunding Investment Mistakes

Crowdfunding offers exciting opportunities for aspiring entrepreneurs and investors alike. However, it’s crucial to navigate this landscape cautiously to avoid potential pitfalls. Here are the 5 top crowdfunding investment mistakes to steer clear of:

- Not Researching Enough: Many investors jump into crowdfunding without thoroughly researching the project, its market viability, or the credibility of its creators, leading to uninformed investment decisions.

- Ignoring Risks: Crowdfunding investments carry inherent risks, including project failure or delays. Investors often overlook these risks, attracted by the potential of high returns or the appeal of the project.

- Failing to Diversify: Investing all funds in a single crowdfunding project is risky. Diversification across multiple projects can mitigate risks and increase the chances of a successful return.

- Overlooking Terms and Conditions: Investors sometimes neglect to fully understand the terms of the crowdfunding campaign, such as equity offered, return expectations, and timelines, leading to misaligned expectations.

- Emotional Decision-Making: Decisions based more on personal interest or emotions rather than on solid financial analysis can lead to poor investment choices, as the project’s appeal may not translate into financial success.

How To Avoid Crowdfunding Investment Mistakes?

To avoid common mistakes in crowdfunding investment, it’s crucial to adopt a strategic and informed approach. Begin with thorough research; delve into the details of the project, understand the credentials and track record of the team behind it, and assess the project’s market viability.

It’s important to be clear about the risks involved recognize that not all projects will succeed and be prepared for the possibility of delays or failure. Diversification is key; spread your investments across different projects to mitigate risk.

Additionally, pay close attention to the terms and conditions of the crowdfunding campaign. Understand the nature of your investment, whether it’s equity, rewards, or debt, and be clear about timelines, return expectations, and the process for updates and communication.

Lastly, keep emotions in check. While passion for a project is good, it should not overshadow sound financial judgment. Investing based on a clear understanding of the project’s potential and financial fundamentals, rather than personal affinity, leads to more prudent decisions.

6 Strategies for Successful Crowdfunding Investment

Surging in popularity, crowdfunding is democratizing investment by offering everyone a chance to participate in funding exciting startups and businesses. To make the most of this opportunity, here are 6 key strategies for successful crowdfunding investment:

- Thorough Research and Due Diligence: Investigate the project, its market potential, the team’s background, and track record. Evaluate the feasibility and scalability of the idea, and review any available data or prototypes.

- Risk Assessment and Management: Understand the risks involved, including the possibility of project delays, underperformance, or failure. Determine your risk tolerance and invest accordingly.

- Diversification of Investments: Spread your investments across different projects and types of crowdfunding (equity, reward-based, debt) to mitigate risks and increase the chances of successful returns.

- Understanding the Platform and Its Policies: Familiarize yourself with the crowdfunding platform’s rules, fees, investment terms, and how it handles unsuccessful campaigns or disputes.

- Active Engagement and Monitoring: Stay engaged with the project’s progress. Follow updates, communicate with creators when necessary, and monitor the project’s development and market changes that might affect it.

- Long-Term Perspective: Approach crowdfunding investment with a long-term view. Many crowdfunding projects, especially equity-based ones, may take time to mature and yield returns. Patience and a long-term perspective are crucial for success.

How Can Crowdfunding Investment Help in Real Estate?

Crowdfunding investment has emerged as a significant player in the real estate sector, offering a novel way for individuals to participate in real estate investments. Traditionally, real estate investing required substantial capital, limiting access to affluent investors.

However, crowdfunding platforms have democratized this process, allowing individuals to invest smaller amounts of money into real estate projects or properties. This method opens opportunities for diversified real estate portfolios, which were once out of reach for the average investor.

Investors can contribute to various projects, from residential developments to commercial real estate, and in return, they receive a share of the profits, either through rental income or the sale of the property.

Crowdfunding in real estate also offers more flexibility and less management hassle compared to traditional property ownership. Investors can choose specific projects that align with their investment goals without the responsibilities of direct property management.

Furthermore, it allows for risk spreading across multiple properties and projects. Overall, crowdfunding in real estate presents a more accessible, diversified, and flexible investment model, making it an attractive option for a broader range of investors.

5 Ways of Choose the Right Crowdfunding Investment

Crowdfunding presents a thrilling opportunity to invest in innovative ideas and potentially reap exciting returns. However, navigating this burgeoning landscape requires careful selection to minimize risk and maximize success. Here are 5 key ways to choose the right crowdfunding investment:

- Align with Investment Goals: Assess your financial goals and risk tolerance. Choose crowdfunding projects that align with your investment strategy, whether it’s short-term gains, long-term growth, social impact, or supporting innovative ideas.

- Conduct Thorough Research: Investigate the project thoroughly. Look into the project’s viability, market potential, and the track record of the team behind it. Analyze their business plan, financial projections, and the uniqueness of the project or product.

- Understand the Type of Crowdfunding: Familiarize yourself with different types of crowdfunding (e.g., equity, reward-based, debt crowdfunding) and choose the one that fits your investment profile and expectations regarding returns and involvement.

- Evaluate the Platform’s Credibility: Choose a reputable crowdfunding platform. Research the platform’s history, success rate, user reviews, and how they handle project vetting, investor communication, and fund management.

- Diversification of Portfolio: Don’t put all your eggs in one basket. Diversify your investments across various projects and sectors to mitigate risk. This approach can balance out potential losses with other successful investments.

Which Crowdfunding Investment Should You Consider for 2024?

For 2024, when considering crowdfunding investments, it’s important to look at emerging trends and sectors showing promise. Technology, especially in areas like green tech, sustainable energy solutions, and AI, is a rapidly growing field with a lot of potential for crowdfunding.

Healthtech and biotech are also promising, particularly with ongoing advancements in personalized medicine and health-related technologies. Real estate remains a solid choice, as crowdfunding platforms have made this market more accessible, offering opportunities in both residential and commercial properties.

Social impact projects and startups are gaining traction among investors who aim to combine making a positive societal impact with the pursuit of financial returns. These ventures are attracting attention for their dual focus on social change and profitability.

Lastly, the creative industries, including gaming, film, and music, have seen a surge in crowdfunding success, attracting investors interested in supporting innovative and creative projects.

3 Tips for a Successful Crowdfunding Investment

Navigating the exciting yet sometimes perplexing world of crowdfunding investment can be thrilling! To increase your chances of success and avoid costly missteps, here are 3 crucial tips to remember:

- In-Depth Research: Before investing, thoroughly research the project or venture. This includes understanding the business model, assessing the project’s market viability, and evaluating the team behind it. Look into the project’s history, its growth potential, and how well it’s been received by the market or community.

- Risk Assessment and Management: Acknowledge and understand the risks involved in crowdfunding. These can range from project delays to complete failures. It’s crucial to assess your risk tolerance and invest funds that you are prepared to risk. Be realistic about the potential for financial loss and the volatility of start-up investments.

- Portfolio Diversification: Don’t put all your funds into one project. Diversify your investments across various crowdfunding ventures and sectors to minimize risk. This approach not only reduces the impact of any single project’s failure but also increases the chances of participating in a successful venture.

Conclusion

Crowdfunding investment offers a unique blend of accessibility and opportunity, both for investors and entrepreneurs. It allows individuals to support and invest in a diverse range of projects, from innovative startups to real estate and social ventures.

However, investors need to approach crowdfunding with a strategic mindset, recognizing the risks involved and the need for thorough research and diversification.

As this sector continues to grow and evolve, it remains a compelling option for those looking to engage with new investment opportunities and contribute to projects with the potential for both financial returns and meaningful impact.

FAQs

What are the main types of crowdfunding?

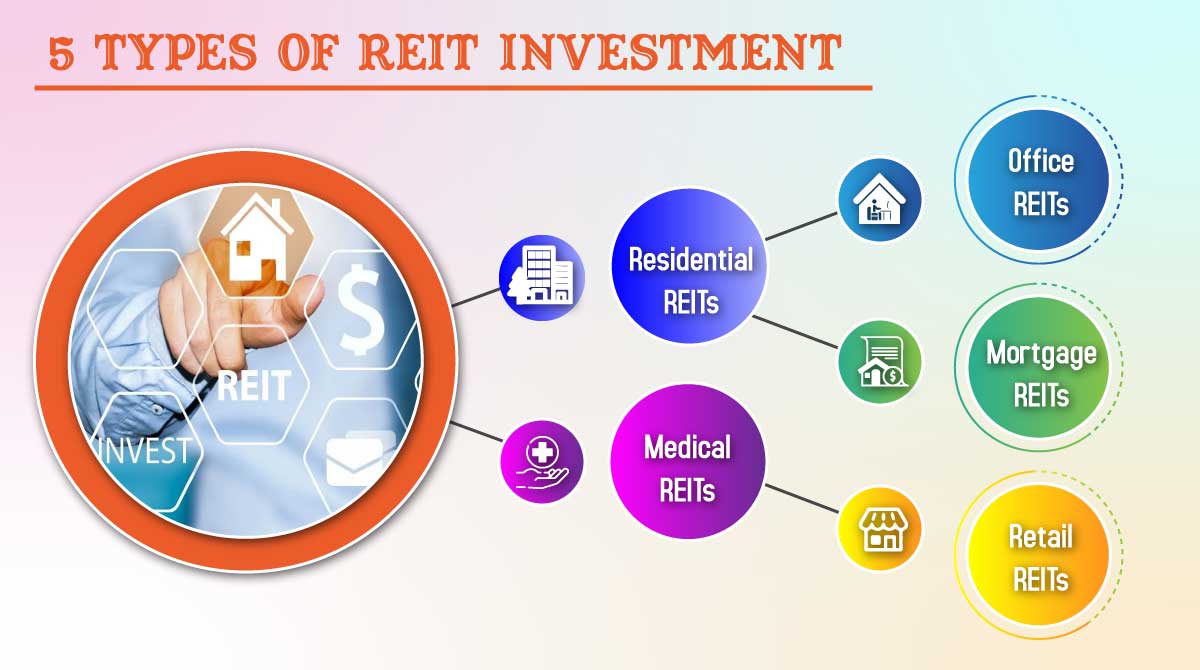

The main types include equity crowdfunding (investors receive shares of the company), debt crowdfunding (money is lent to the company and paid back with interest), rewards-based crowdfunding (backers receive a tangible item or service in return for their funds), and donation-based crowdfunding.

How does equity crowdfunding work?

In equity crowdfunding, investors purchase a small stake in a startup or small business. If the business does well, the value of the shares can increase. However, if the business fails, investors may lose their investment.

What are the risks involved in crowdfunding investment?

Risks include the potential loss of investment, project delays, or the business not performing as expected. Equity crowdfunding also carries the risk of diluted share value and lack of liquidity.