Real Estate Equity Crowdfunding Investment has revolutionized how individuals access the property market. No longer reserved for the ultra-wealthy, this method allows investors to pool financial contributions to fund high-value residential and commercial projects. Whether you are looking for passive income or long-term capital appreciation, understanding the nuances of equity versus debt crowdfunding is essential for building a robust portfolio in the current economic landscape.

Key Takeaways

- High Accessibility: Investors can often enter the market with as little as $500, though some platforms require Accredited Investor status.

- Equity vs. Debt: Equity investments offer higher potential returns (18–25%+) through ownership, while Debt investments provide stable, lower-risk income (8–12%).

- Market Growth: The global crowdfunding sector continues to expand, projecting significant growth through 2025 and beyond.

- Risk Profile: While profitable, these investments are illiquid; capital is typically tied up for 3 to 10 years.

What Is Real Estate Crowdfunding?

Real estate crowdfunding is a financial strategy where a “sponsor” (developer) raises capital from a large pool of individuals online to finance a property project. Instead of a single investor buying a building, hundreds of investors contribute small amounts to own a share of the project or lend money to the developer.

This creates a unique opportunity for smart investors to get in on the “ground floor” of lucrative commercial or residential deals that were previously inaccessible.

Market Growth and Statistics

The sector is witnessing explosive growth. While early valuations in 2018 sat around $10.2 billion, recent market analysis suggests the global crowdfunding market is on a trajectory to exceed $28.8 billion by 2025. As of 2024, the average funding per campaign has seen an uptick, driven by increased digital adoption and trust in online investment platforms (also known as Portals).

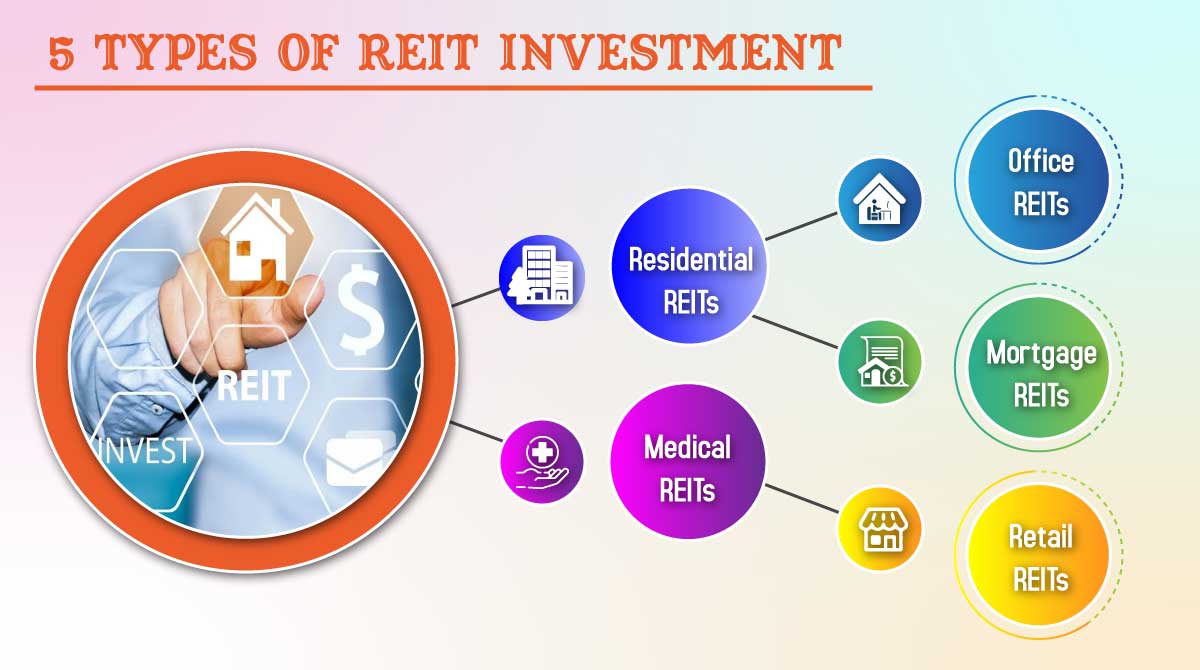

What Are the Types of Real Estate Crowdfunding?

There are two primary vehicles for investing in this space: Equity Investments and Debt Investments. Understanding the difference is critical for risk management.

1. What Is an Equity Investment?

Equity investment involves purchasing a stake in the property itself. As an investor, you become a shareholder in the holding company that owns the real estate.

- Potential Returns: Returns are theoretically unlimited. If the property value skyrockets, so does your profit. Investors often target an 18% to 25% annualized return (IRR).

- Cost Structure: Instead of upfront fees, investors typically pay an annual asset management fee (usually 1-2%) to the sponsor.

- Tax Benefits: As a partial owner, you may benefit from pass-through depreciation, allowing you to deduct certain costs from your taxable income.

2. What Is a Debt Investment?

Debt investment effectively makes you the lender. You are lending money to the property owner to fund the development or renovation.

- Stable Returns: You receive a fixed interest rate based on the mortgage loan terms. Returns typically range between 8% and 12% annually.

- Lower Risk: Debt holders are paid first. If a project fails, debt investors have a priority claim on the asset (often via foreclosure) before equity investors see a penny.

- Shorter Terms: These investments are often shorter, with holding periods ranging from 6 to 24 months, offering faster liquidity than equity deals.

Comparison: Equity vs. Debt Crowdfunding

Feature | Equity Investment | Debt Investment |

Role | Shareholder / Owner | Lender |

Risk Level | Higher | Lower |

Potential Return | High (18-25%+) | Moderate/Fixed (8-12%) |

Payout Frequency | Quarterly or at Exit | Monthly or Quarterly |

Liquidity | Low (3-10 Years) | Moderate (6-24 Months) |

Worldwide Volume of Crowdfunding Investment

What Are the Pros and Cons of Real Estate Crowdfunding?

Before committing capital to a crowdfunded real estate project, weigh the benefits against the limitations.

Pros

- Higher Dividends: Typically outperforms traditional REITs and stock market averages.

- Diversification: Allows you to spread capital across different geographies and asset classes (e.g., multi-family, industrial).

- Passive Income: Eliminates the “landlord headaches” of fixing toilets and managing tenants; the sponsor handles operations.

- Low Barrier to Entry: Requires significantly less capital than buying a physical property.

Cons

- Illiquidity: You cannot easily sell your shares. Your money is locked until the sponsor sells or refinances the property.

- Platform Fees: Investors may be subject to management, advisory, or platform fees that eat into profits.

- Risk of Loss: If the platform fails or the project goes bankrupt, there is a risk of losing the principal investment.

- Lack of Control: You have no say in the day-to-day management decisions of the property.

How to Get Started with Real Estate Crowdfunding

Starting your journey requires due diligence. Follow these steps to minimize risk and maximize potential gains:

- Platform Research: Compare Crowdfunding Platforms based on their track record, fee structures, and default rates.

- Verify Accreditation: Determine if the platform requires you to be an Accredited Investor (net worth over $1M or income over $200k/year) or if it is open to non-accredited investors.

- Analyze the Deal: Review the specific property details, the sponsor’s history, and the projected Internal Rate of Return (IRR).

- Prepare Documentation: Have your financial documents and tax returns ready to prove your investor status if required.

FAQ

What is the minimum amount required to invest in real estate crowdfunding?

The minimum investment varies by platform and project type. Some “eREIT” platforms allow entry for as low as $500 to $1,000. However, direct equity deals for specific properties often require a minimum buy-in of $25,000 to $50,000.

Is real estate crowdfunding safe?

Real estate crowdfunding carries inherent risks. While platforms perform due diligence, you have no control over the project’s execution. Market downturns or construction delays can impact returns. However, Debt Investments are generally considered safer than equity because they are secured by the property itself.

How profitable is real estate crowdfunding?

Profitability depends on the deal structure. Investors generally anticipate a return of 10% to 20% or more. However, these are long-term plays; capital is typically illiquid for three to ten years to allow the property to appreciate and the business plan to be executed.