Commercial property is considered a wise investment choice for several compelling reasons. Firstly, it often offers higher rental yields compared to residential real estate, providing a steady source of income for investors.

Additionally, commercial tenants, typically businesses, are often more reliable and inclined to maintain the property well to uphold their professional image, reducing maintenance and management concerns for the owner.

Another significant benefit of commercial real estate is the potential for value growth, particularly in prime locations. The diverse market, encompassing office spaces, retail units, and industrial properties, allows investors to diversify their investments and mitigate risk.

Furthermore, owning commercial property also provides tax advantages, such as deductions on depreciation, maintenance costs, and loan interest, making it a potentially profitable and stable investment for various investors.

How to Secure Financing for Commercial Property Investment?

Securing financing for commercial property investment involves several key steps. Initially, it’s crucial to have a clear and detailed business plan that outlines the investment’s potential profitability and risks.

Next, investors should research and compare different financing options, including traditional commercial mortgages, government-backed loans, and private lenders, to find the most suitable terms.

Additionally, investors often need to provide a substantial down payment, typically higher than that for residential properties, and should be prepared for this financial commitment. It’s advisable to seek the expertise of financial advisors or mortgage brokers who specialize in commercial real estate to navigate the complex financing landscape.

Lastly, it’s essential to understand the market and the investment’s potential returns, as lenders assess the property’s profitability and the borrower’s repayment capacity. Thorough preparation and research can help investors successfully obtain financing for commercial property investments.

7 Pros of Investing in Commercial Property

Investing in commercial property offers several key advantages:

1. Higher Rental Yields: Generally, commercial properties offer higher rental income compared to residential properties.

2. Long-Term Lease Agreements: Tenants in commercial properties often sign longer leases, providing stable and predictable income.

3. Reliable Tenants: Businesses, especially established ones, tend to be reliable renters and are likely to maintain the property well to preserve their professional image.

4. Diversification: Investing in different types of commercial properties (like retail, office, or industrial) helps diversify investment portfolios and reduce risk.

5. Inflation Hedge: Commercial leases often include rent escalations linked to inflation, protecting the investor’s income against inflationary pressures.

6. Tax Benefits: Potential for various tax deductions, including mortgage interest, property taxes, and depreciation.

7. Prestige and Networking: Owning commercial property can elevate an investor’s profile and provide networking opportunities with other businesses and investors.

Do Economic Trends Affect Commercial Property Investments?

Economic trends significantly affect commercial property investments. The performance of the commercial real estate market is closely tied to the broader economy. Factors such as GDP growth, employment rates, consumer spending, and business confidence directly influence the demand for commercial spaces.

For instance, a thriving economy typically leads to increased demand for office and retail spaces as businesses expand. Conversely, economic downturns can lead to higher vacancy rates and reduced rental incomes.

Interest rates are another crucial factor; lower rates can make financing more accessible and increase investment in real estate, while higher rates may have the opposite effect. Additionally, sector-specific trends, like the growth of e-commerce, have reshaped the demand for retail versus industrial spaces.

The rise of remote work, particularly highlighted during the COVID-19 pandemic, has also impacted the demand for office spaces. Therefore, investors in commercial real estate need to stay informed about economic trends and adapt their strategies accordingly to manage risks and capitalize on opportunities.

6 Common Risks Involved in Commercial Property Investment

Investing in commercial property, like any investment, involves certain risks. Being aware of these risks is crucial for making informed decisions. Here are some of the common risks involved:

1. Market Risk: Fluctuations in the real estate market can affect property values and rental rates. Economic downturns can lead to reduced demand and lower returns.

2. Liquidity Risk: Commercial properties are not as liquid as other investments, like stocks or bonds, making it potentially challenging to sell quickly without a loss.

3. Tenant Risk: Dependence on tenants for income can be risky, especially if tenants default on rent, vacate, or if there’s prolonged vacancy.

4. Interest Rate Risk: Rising interest rates can increase borrowing costs and reduce profit margins, especially for those with variable-rate loans.

5. Lease Length Risk: Long-term leases can provide stability but might also lock in lower rental rates, especially if market rates increase.

6. Location Risk: Property value and demand can be highly dependent on location, which might change due to various factors like infrastructure developments or shifts in demographics.

How to Identify the Profitable Commercial Property for Investment?

Identifying a profitable commercial property for investment requires careful consideration of several key factors. First and foremost, location is paramount; properties in prime areas with high foot traffic or in developing regions with growth potential are often more lucrative.

Investors should also analyze market trends, including the current supply and demand dynamics in the area for different types of commercial properties. It’s important to assess the property’s condition and renovation costs, as these can significantly impact profitability.

Additionally, investors should consider the property’s yield potential, examining current rental incomes against operating expenses to gauge the net income. The type of property also plays a role, with different sectors having varying risk and return profiles.

Conducting a thorough due diligence process, including legal checks and compliance with zoning laws, is essential. Lastly, consulting with real estate experts and financial advisors can provide valuable insights and help identify properties with the best potential for a strong return on investment.

Myths About Commercial Property Investment Debunked

Several myths surrounding commercial property investment often mislead or deter potential investors, but a closer examination reveals the truth. One common myth is that commercial real estate is reserved only for wealthy or experienced investors.

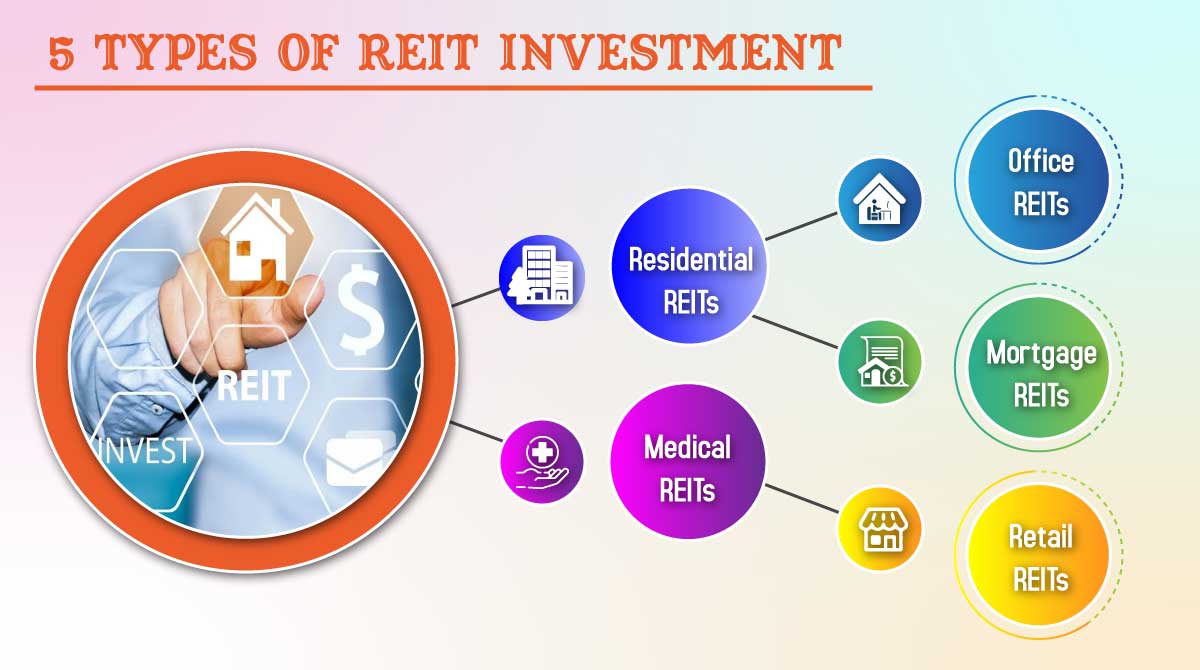

In reality, while commercial properties can require significant capital, various financing options, and investment structures, like real estate investment trusts (REITs), make it accessible to a broader range of investors.

Like any investment, it carries inherent risks, including market fluctuations and tenant variability, and requires careful research and management. The belief that commercial properties are always a better choice than residential properties is another oversimplification.

Finally, the notion that online shopping has made retail spaces obsolete is an exaggeration; while e-commerce has changed the landscape, many retail and mixed-use commercial spaces continue to thrive by adapting to new consumer behaviors. Debunking these myths is crucial for a realistic understanding of commercial property investment.

Top 5 Commercial Property Investment Tips for 2024

For those looking to invest in commercial property in 2024, here are the top five tips to consider:

1. Embrace Market Research: Understanding current market trends, economic forecasts, and local demand is crucial. Stay informed about factors like emerging business sectors, shifts in consumer behavior, and technological advancements that could impact commercial real estate.

2. Focus on Location: The adage location holds especially true for commercial property. Look for properties in areas with strong economic growth, good infrastructure, and accessibility. Emerging neighborhoods and regions with planned development projects can also be promising.

3. Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversifying your investments across different types of commercial properties (retail, office, industrial) and locations can reduce risk and stabilize your income stream.

4. Prioritize Tenant Quality: Strong, reliable tenants can make a significant difference. Look for properties with established businesses as tenants, or those that attract reputable companies, ensuring a steady rental income and reduced vacancy rates.

5. Plan for Flexibility and Adaptability: The commercial real estate market is evolving rapidly. Properties that can be easily adapted for various uses or that cater to evolving business models (like e-commerce or hybrid work environments) could offer more resilience against market changes.

Conclusion

Commercial property investment offers a unique opportunity for significant financial returns and portfolio diversification. While it comes with its own set of challenges and risks, informed and strategic decision-making can lead to profitable outcomes.

Key to success in this field is a deep understanding of the market trends, a focus on prime locations, tenant quality, and property type diversification. Additionally, adapting to the evolving real estate landscape, such as shifts in consumer behavior or technological advancements, is crucial.

Investors who approach commercial property investment with thorough research, careful planning, and flexibility are well-positioned to capitalize on its benefits. The commercial property market, with its dynamic nature and growth potential, remains an attractive avenue for investors looking to expand their portfolios and achieve long-term financial goals.

FAQs

Is Commercial Property a Good Investment?

Yes, it can be a good investment due to potentially higher rental yields, longer lease terms, and the opportunity for capital growth. However, it also comes with unique risks and requires careful market analysis.

What Types of Commercial Properties Can I Invest In?

You can invest in various types, including office spaces, retail stores, industrial warehouses, multifamily apartment buildings, and special-purpose buildings like hotels or hospitals.

How Much Capital is Needed to Invest in Commercial Property?

The capital required varies widely depending on the property type and location. Investors typically need a significant upfront investment for down payments and should also account for ongoing maintenance and operational costs.

Are There Tax Benefits in Commercial Property Investment?

Yes, investors can benefit from tax deductions on mortgage interest, property taxes, operating expenses, and depreciation.