Investing in commercial real estate can be a lucrative venture, but it also comes with its share of risks and complexities. To ensure success, there are several key do’s and don’ts to keep in mind. On the do’s side, thorough research is paramount.

It’s crucial to conduct comprehensive due diligence on the property, location, and market trends. Seek professional guidance from experienced real estate advisors and consider diversifying your portfolio to spread risk. Moreover, understanding your financial capabilities and having a well-defined investment strategy is essential.

On the flip side, the don’ts include avoiding emotional decisions and impulsive purchases. Don’t overextend your finances or underestimate ongoing expenses like maintenance and property management. Additionally, refrain from neglecting legal and regulatory considerations, such as zoning laws and permits.

Lastly, don’t forget the importance of contingency planning and having an exit strategy in case the investment doesn’t perform as expected. In summary, success in commercial real estate investing requires diligence, expertise, and a strategic approach while avoiding hasty decisions and overlooking critical factors.

Do’s and Don’ts for Sustainable Commercial Real Estate

Achieving sustainability in commercial real estate is not only environmentally responsible but can also be financially advantageous. Here are some key dos and don’ts for sustainable commercial real estate:

Do’s:

- Energy Efficiency: Invest in energy-efficient technologies and practices, such as LED lighting, HVAC upgrades, and smart building systems to reduce energy consumption and operational costs.

- Green Building Certifications: Consider obtaining green building certifications like LEED (Leadership in Energy and Environmental Design) or ENERGY STAR to enhance your property’s marketability and sustainability credentials.

- Renewable Energy: Explore renewable energy sources like solar panels or wind turbines to generate clean and cost-effective power for your property.

- Sustainable Materials: Use eco-friendly construction materials and products that have a lower environmental impact and promote better indoor air quality.

- Water Conservation: Implement water-efficient fixtures, landscaping, and irrigation systems to reduce water usage and minimize utility expenses.

- Waste Reduction: Establish recycling and waste reduction programs to minimize landfill waste and promote recycling and composting.

- Transportation Access: Choose properties with easy access to public transportation and encourage sustainable commuting options for tenants and employees.

Don’ts:

- Ignoring Sustainability: Don’t overlook sustainability as a consideration when purchasing or developing commercial real estate. Sustainable features can enhance long-term value.

- Neglecting Maintenance: Avoid neglecting maintenance of green technologies and practices, as their effectiveness can deteriorate over time without proper upkeep.

- Overlooking Local Regulations: Don’t ignore local sustainability regulations and incentives, which can provide financial benefits and influence property values.

- Not Engaging Tenants: Avoid failing to involve tenants in sustainable practices. Educate and collaborate with them to achieve sustainability goals.

- Ignoring Lifecycle Costs: Don’t focus solely on upfront costs; consider the lifecycle costs and long-term savings associated with sustainable investments.

- Inflexibility: Be open to adaptability and innovation in sustainable practices; don’t stick to outdated methods if more efficient and eco-friendly alternatives become available.

- Greenwashing: Avoid misleading claims or exaggerations regarding sustainability features. Be transparent and truthful about your property’s green initiatives.

Sustainable commercial real estate can benefit both the environment and your bottom line. To succeed, prioritize energy efficiency, green certifications, and eco-friendly practices while avoiding common pitfalls such as neglecting maintenance or failing to engage tenants in sustainability efforts.

6 Risk Management in Commercial Real Estate: Best Practices

Commercial real estate investments come with various risks. Here are six main risks in commercial real estate and best practices for managing them:

- Market Risk: Market risk is the risk associated with changes in supply and demand, economic conditions, and market cycles. It can impact property values and rental income.

- Credit Risk: Credit risk arises from tenant defaults on lease payments or loans, potentially leading to reduced rental income or property value.

- Interest Rate Risk: Interest rate risk pertains to fluctuations in interest rates, which can affect financing costs and property valuations.

- Property-Specific Risk: This risk involves issues specific to the property, such as environmental hazards, structural problems, or zoning issues.

- Liquidity Risk: Liquidity risk arises when it is challenging to sell a property quickly or at a desired price, leading to limited access to capital.

- Regulatory and Legal Risk: Regulatory and legal risks involve changes in laws, regulations, or zoning codes that can affect property usage or create compliance challenges.

Useful 5 Tips for Commercial Real Estate

Here are five useful tips for success in the world of commercial real estate:

- Conduct Thorough Due Diligence: Before investing in any commercial property, conduct comprehensive due diligence. This includes inspecting the property, reviewing financial records, assessing market conditions, and evaluating potential risks.

- Build Strong Relationships: Building and maintaining relationships with industry professionals, including real estate agents, property managers, contractors, and financiers, is crucial.

- Diversify Your Portfolio: Avoid putting all your resources into a single property or property type. Diversifying your portfolio across different asset classes and geographic locations can help spread risk and enhance long-term stability.

- Understand the Market: Stay informed about local and national real estate market trends and economic conditions. Knowing the current market dynamics, rental rates, and future growth prospects is essential for making informed investment decisions.

- Focus on Cash Flow: Commercial real estate investments should primarily generate income through rental payments. Ensure that your properties are cash flow-positive, and carefully manage expenses.

Conclusion

Commercial real estate presents a promising avenue for investors, but it demands a strategic and informed approach. Success in this sector hinges on diligent research, strong industry relationships, and a commitment to diversification.

A comprehensive understanding of the market, local conditions, and regulatory nuances is essential. Prioritizing cash flow through effective property management and tenant relationships is vital for sustained profitability.

Moreover, commercial real estate investments typically require a long-term perspective and an ability to adapt to changing market dynamics. In navigating the complexities of this field, investors can unlock the potential for both financial growth and wealth accumulation while managing the associated risks effectively.

FAQs

How do I invest in commercial real estate?

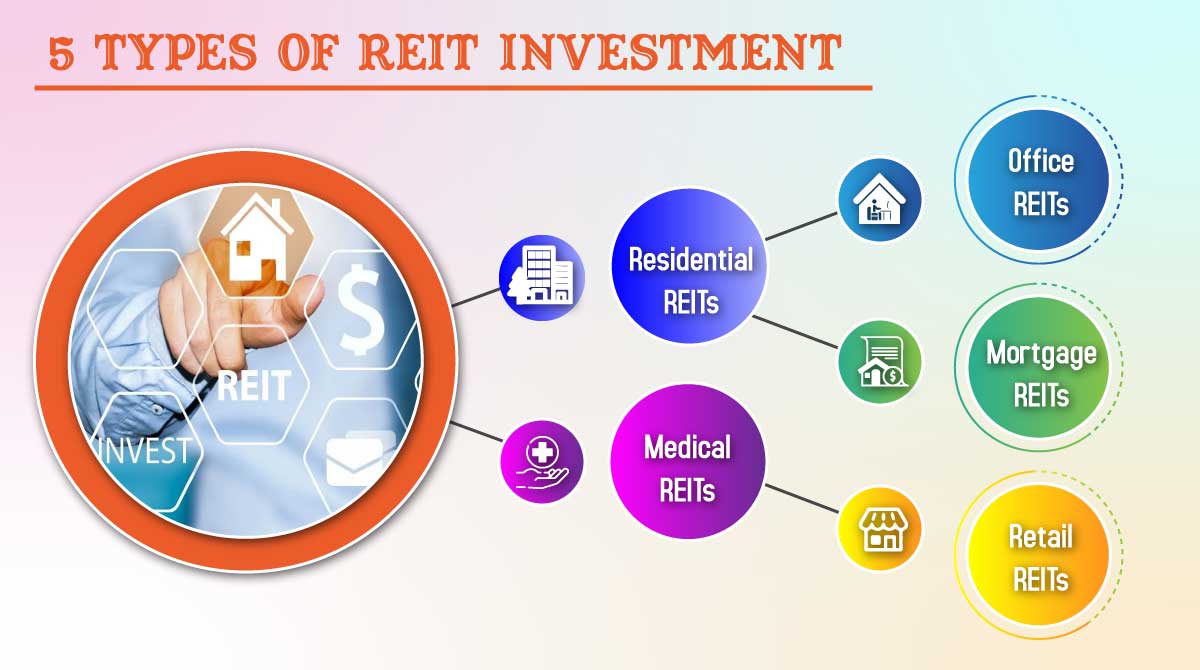

Investing in commercial real estate typically involves purchasing a property or participating in a real estate investment partnership (REITs, syndications, or funds).

What is due diligence in commercial real estate?

Due diligence is the process of thoroughly researching and evaluating a commercial property before purchase. It involves inspections, financial analysis, market research, and legal reviews to assess the property’s suitability and risks.

What are the benefits of investing in commercial real estate?

Benefits include the potential for rental income, appreciation of property value, portfolio diversification, tax advantages, and the ability to leverage financing to amplify returns.

What types of commercial properties are there?

Commercial properties can be categorized into several types, including office buildings, retail centers, industrial warehouses, multifamily apartments, hotels, and special-purpose properties like healthcare facilities or storage units.