We at Reitbd specialize in connecting ambitious investors with profitable real estate opportunities. Our mission is to help clients create, grow, and safeguard their wealth through strategic commercial property investments.

For anyone looking to diversify their portfolio and secure a stress-free financial future, understanding Real Estate Investment Trusts (REITs) is essential.

The Foundation of Real Estate Investment: Understanding REITs

REITs generate income primarily through leasing properties and collecting rent, which is then distributed as dividends to shareholders. Some REITs focus on a single property type, while diversified or specialty REITs combine multiple asset classes to mitigate risk and enhance returns.

For investors seeking long-term growth, passive income, and portfolio diversification, understanding how REITs operate is fundamental to building a secure and profitable real estate investment strategy.

What is a Real Estate Investment Trust (REIT)?

A REIT is a company that owns, manages, or finances income-generating real estate. Modeled after mutual funds, REITs pool capital from multiple investors, allowing individuals to benefit from real estate income without directly managing or financing properties themselves.

How REIT Portfolios Diversify

Most REITs operate by:

- Leasing out properties

- Collecting rent

- Distributing dividends to shareholders

While many REITs focus on specific property types such as shopping centers, data centers, or forests, diversified and specialty REITs may hold multiple property types including:

- Retail and office spaces

- Apartments, hospitals, hotels, warehouses

- Infrastructure such as cellphone towers and energy pipelines

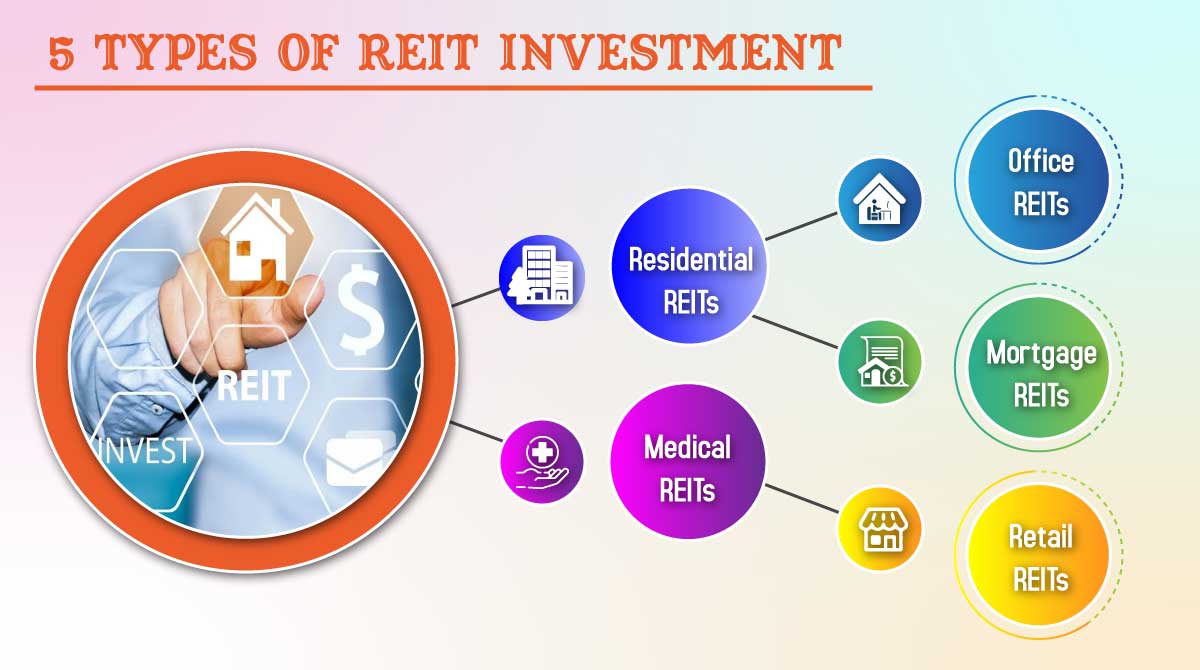

Exploring Diverse Real Estate Investment Categories

Real estate investment offers a wide range of opportunities, catering to different risk profiles, income expectations, and long-term goals. At Reitbd, investors can access both commercial and residential properties, each with distinct advantages. Reitbd provides access to a wide range of high-return real estate investments.

1. Commercial vs. Residential Property

- Commercial Property: High-value sectors such as offices, retail spaces, and industrial assets

- Residential Property: Rental properties intended for tenants rather than owners

2. Targeting Rental Income Streams

- Long-Term Rentals: Structured yearly contracts provide stable and predictable income

- Short-Term Rentals: Popular among tourists seeking cost-effective alternatives to hotels

3. Specialized Investment Opportunities

- Retirement Planning: Rental properties can diversify retirement savings and provide long-term income

- Raw Land Investment: Investing in undeveloped land is a growing trend with high future potential

Additionally, specialized investments such as raw land or properties intended for future development offer opportunities for significant capital appreciation. By understanding these diverse categories, investors can diversify their portfolios effectively, balance risk and reward, and position themselves for sustainable financial growth through real estate.

Key Benefits of REIT Investments

Investing in REITs offers several advantages for both novice and experienced investors.

Attractive Dividends

Dividends are distributed based on the number of units owned, representing a share of the company’s profits.

Capital Gains

Investors can achieve long-term growth as property values and share prices increase. REIT earnings are often boosted by:

- Higher revenues

- Strategic business opportunities

- Efficient cost management

Liquidity

Listed REIT shares are highly liquid, making it easy to buy or sell without the complexities of direct real estate investments.

Understanding REIT Structures

Real Estate Investment Trusts (REITs) are structured to generate income for investors through either ownership of properties or financing real estate. Broadly, REITs are classified into Equity REITs and Mortgage REITs (mREITs), each serving a distinct purpose.

Understanding these structures helps investors align their risk tolerance and income expectations with the right type of REIT, ensuring a strategic and well-informed approach to real estate investment.

Equity vs. Mortgage REITs

- Equity REITs: Own and operate income-generating properties

- Mortgage REITs (mREITs): Finance real estate by purchasing loans, mortgage-backed securities, or issuing credit to property owners

Reitbd’s Expertise and Industry Leadership

With over 20 years of experience in the real estate sector, Reitbd has established itself as a trusted partner for investors seeking high-return commercial property opportunities. Our team combines deep market knowledge, financial expertise, and consulting experience to guide clients in creating and safeguarding their wealth through strategic property investments.

Proven Experience and Geographic Reach

- Over 20 years of helping clients grow and protect wealth through commercial property investment

- Expanded from a single office in Bangladesh to multiple locations across Dhaka

- Supported by the largest and most dependable sales team in the industry

- Team experience includes 10 years in investment and finance and 12 years in consulting

Industry Influence

- Serves as a trusted voice in Bangladesh’s real estate sector

- Advocates for REIT adoption with policymakers

- Provides global guidance for countries implementing or considering REIT regulations

Who Invests in REITs?

REITs attract a wide spectrum of investors, offering opportunities for both individuals and institutions to participate in real estate markets without directly owning or managing properties. Individual investors, regardless of age or experience, can benefit from the dividends and capital appreciation that REITs provide, making them an accessible and flexible investment option.

Institutional investors also play a significant role in the REIT market. These include family offices, insurance companies, banks, foundations, endowments, and pension funds, all of which leverage REITs to diversify portfolios, secure stable income, and achieve long-term growth.

Understanding who participates in REIT investments helps investors appreciate the liquidity, stability, and market credibility that these trusts offer.

REITs attract a broad spectrum of investors:

- Individuals of all ages

- Institutional investors such as family offices, insurance companies, banks, foundations, endowments, and pension funds

Your Next Step Towards High-Return Investment

Investing in REITs is a strategic move for a secure and stress-free financial future.

Investing in REITs is a strategic move toward financial security and long-term wealth creation. By participating in income-generating real estate through Reitbd, investors gain access to diversified portfolios, attractive dividends, and potential capital appreciation without the complexities of direct property management.

If you are ready to explore high-return real estate opportunities, contact a Reitbd specialist today and start planning your path to financial success.