Investing in Real Estate Investment Trusts (REITs) is one of the most efficient ways to build wealth through property without the headaches of traditional landlording. As we enter 2026, the landscape for REIT investment platforms has evolved, offering lower entry barriers and higher transparency. Whether you are seeking monthly dividends or long-term capital appreciation, choosing the right platform is the foundation of your success. This guide explores the top-rated platforms, current market trends, and a step-by-step strategy for modern investors.

Key Takeaways

- Low Entry Barriers: Platforms like Fundrise now allow investments starting as low as $10, making real estate accessible to everyone.

- 2026 Market Catalyst: Analysts predict a 15% rise in global real estate investment this year, driven by stabilized interest rates and demand for AI Data Centers.

- Passive Income: Most REITs are legally required to distribute at least 90% of taxable income to shareholders, ensuring consistent dividend flow.

- Digital-First IR: Modern Investor Relations (IR) portals now offer real-time tracking and blockchain-backed transparency for retail investors.

What are the Best REIT Investment Platforms for 2026?

The best REIT investment platforms in 2026 are those that balance low fees, high liquidity, and robust Topical Authority. For retail investors, Fundrise and RealtyMogul lead the market by offering access to private and public-non-listed REITs. For those seeking maximum liquidity, traditional brokerages like Fidelity or Vanguard remain the gold standard for trading publicly listed REIT shares and ETFs.

Comparison of Top REIT Platforms (2026 Data)

Platform | Target Investor | Minimum Investment | Key Feature |

Fundrise | Beginners | $10 | Highly diversified “eREITs” |

RealtyMogul | Intermediate | $5,000 | Focus on grocery-anchored retail |

EquityMultiple | Accredited | $5,000 | Institutional-grade commercial deals |

Fidelity | All Levels | $0 (Share price) | Zero-commission REIT stocks/ETFs |

Arrived | Income Seekers | $100 | Fractional single-family rentals |

How Do I Pick the Best Platform for REIT Investment?

To pick the best REIT platform, you must evaluate the Minimum Contributions, Service Charges, and the historical Dividend Yield. In 2026, savvy investors also prioritize Website Accessibility and the quality of digital Investor Relations tools. According to Nareit 2025 studies, total dividends paid by REITs increased by 6.3% year-over-year, making historical payout consistency a critical metric for platform selection.

Critical Selection Criteria:

- Fee Structure: Look for platforms with transparent management fees (typically 0.5% to 1.5%).

- Liquidity Needs: Publicly traded REITs offer daily liquidity, while private platforms may require a 5-year holding period.

- Asset Specialization: Choose platforms that align with high-growth 2026 sectors like Industrial Logistics or Healthcare Facilities.

Why Is REIT Investor Relations Important for You?

REIT Investor Relations (IR) acts as the bridge between the trust’s management and its shareholders, ensuring that the Net Asset Value (NAV) and operational performance are reported accurately. Effective IR teams provide the data necessary for you to determine if a company is a viable long-term hold.

In 2026, Investor Relations has shifted toward ESG (Environmental, Social, and Governance) reporting. Platforms now use AI-powered dashboards to show investors how their capital is performing relative to sustainability targets. This transparency is vital for building Trustworthiness, a core pillar of modern investment.

How to Invest in REITs: A Step-by-Step 2026 Guide

Investing in REITs in 2026 is a streamlined digital process. You can gain exposure to billion-dollar property portfolios through a few clicks on a smartphone or desktop.

4 Steps to Get Started:

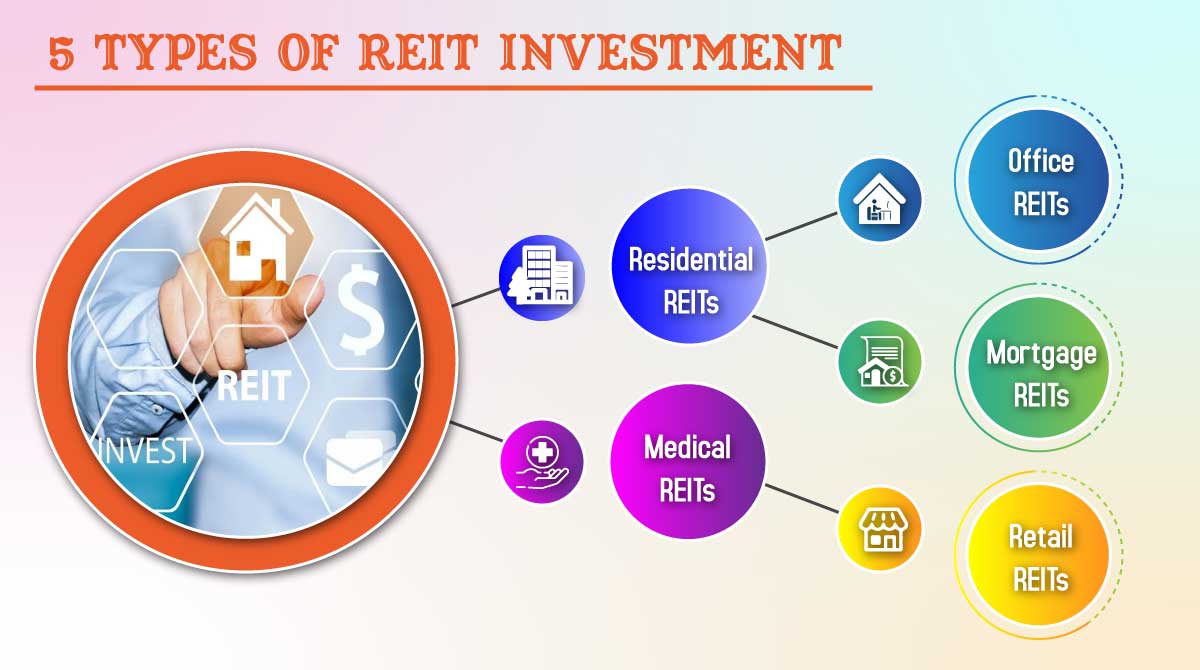

- Choose Your Investment Type: Decide between Publicly Traded REITs (high liquidity), Public Non-Listed REITs, or Private REITs (higher potential yield but less liquid).

- Open a Brokerage or Platform Account: For stocks, use Fidelity or M1 Finance. For crowdfunding, choose Fundrise.

- Research the Sector: Focus on “Alternative REITs” such as Data Centers (benefiting from the AI boom) and Cold Storage warehouses.

- Execute the Trade: Buy individual shares or opt for a REIT ETF (like VNQ) for instant diversification across hundreds of properties.

FAQ: Common REIT Investment Questions

What is the minimum amount to invest in a REIT?

For publicly traded REITs, the minimum is the price of a single share (often under $50). On crowdfunding platforms like Fundrise, the minimum is $10. However, for private offerings or accredited investor platforms, minimums typically start at $5,000 to $25,000.

What is a good return on a REIT in 2026?

A “good” total return for a REIT in the current market ranges between 8% and 12% annually. This usually consists of a 4-5% dividend yield combined with 4-7% capital appreciation. Higher-yielding sectors like Healthcare (averaging 7% yields in 2025) may offer more aggressive income but with different risk profiles.

Can I buy 1 share of a REIT?

Yes. If the REIT is listed on a major exchange (like the NYSE), you can purchase a single share through any standard brokerage account. Many modern brokers also offer fractional shares, allowing you to invest as little as $1 in expensive REIT stocks.