Crowdfunding Property Investment has become increasingly popular in recent years. Many successful businesses and organizations have emerged from crowdfunding.

It is expected that there will be 12,063,870 crowdfunding campaigns worldwide by 2023. According to projections, the global crowdfunding industry will nearly triple by 2025.

Perhaps you are considering crowdfunding investment in the future. Then this thought obviously has come across your mind – “Is Crowdfunding Property Investment Worth It or Not?”

Crowdfunding is an excellent way for property investors to obtain initial funding and raise awareness about their venture. It’s also an ideal opportunity for smart investors to be in the basement of some promising ventures while also expanding their portfolios. According to research, successful crowdfunding campaigns raised an average of $28,656.

Without any delay, let’s dive into a deeper discussion!

Is Crowdfunding Worth It For Property Investment?

From developers perspective:

Crowdfunding provides property developers with network access to colleagues, friends, relatives, and even members of the general public via social media sites like LinkedIn, Facebook, and Twitter, as well as various online crowdfunding available on the internet.

From investors perspective:

On the other hand, crowdfunding allows property investors to spread their investment money in lower amounts across so many investments, resulting in greater diversity.

Though crowdfunding for property investment has existed in some form for so many years, it has only recently begun to gain popularity, owing to the explosion of online crowdfunding possibilities and platforms.

Expert’s opinion: To be successful with property investment crowdfunding as an investor, you must choose the appropriate crowdfunding platform.

5 Benefits Of Property Investment Crowdfunding

1. Diversification Of Portfolio: You effectively reduce the risk associated with a single investment by expanding that risk across multiple investments.

2. Accessibility: Crowdfunding has made it much easier to get started in real estate property investing.

3. Geographic diversification: It is essential because different areas of the property market can conduct very differently.

4. Vehicle For Passive Investment: You invest in crowdfunded property investment with a third-party property developer or driver who handles all of the work.

5. Small Investment Size: Due to the small investment size requirements, crowdfunding allows you to become a property investor.

What Makes Crowdfunding Desirable To Investors?

The fact that crowdfunding is a new concept adds to its allure for investors. To be a part of the “ground floor” in what is quite certain to be a potential industry leader has an allure.

Crowdfunding is also a great way for investors who may not have the capital to fund a startup to get involved. Equity crowdfunding campaigns allow you to invest up to €100 or €1000, making it a cost-effective way to build a diverse portfolio.

You’ll also be able to monitor your investment’s progress and see how it’s performing over time. Crowdfunding platforms also enable you to choose which campaigns to support. You have the option of avoiding startups in contentious industries.

3 Risks For Crowdfunding Property Investors

1. High risk: It is crucial to remember that any given startup may fail and your investment may be completely lost. If this occurs, there is no way to recover your initial investment or sue for damages.

2. Competition for attention: As a shareholder on a crowdfunding site, it can be hard to stand out. There are frequently numerous initiatives to choose from, and there is only so much awareness to go around.

3. Fraud risk: Sadly, crowdfunding has a reputation for fraudulent campaigns. As an investor, you must conduct due diligence to ensure that the company you are investing in is valid and has a viable plan for success.

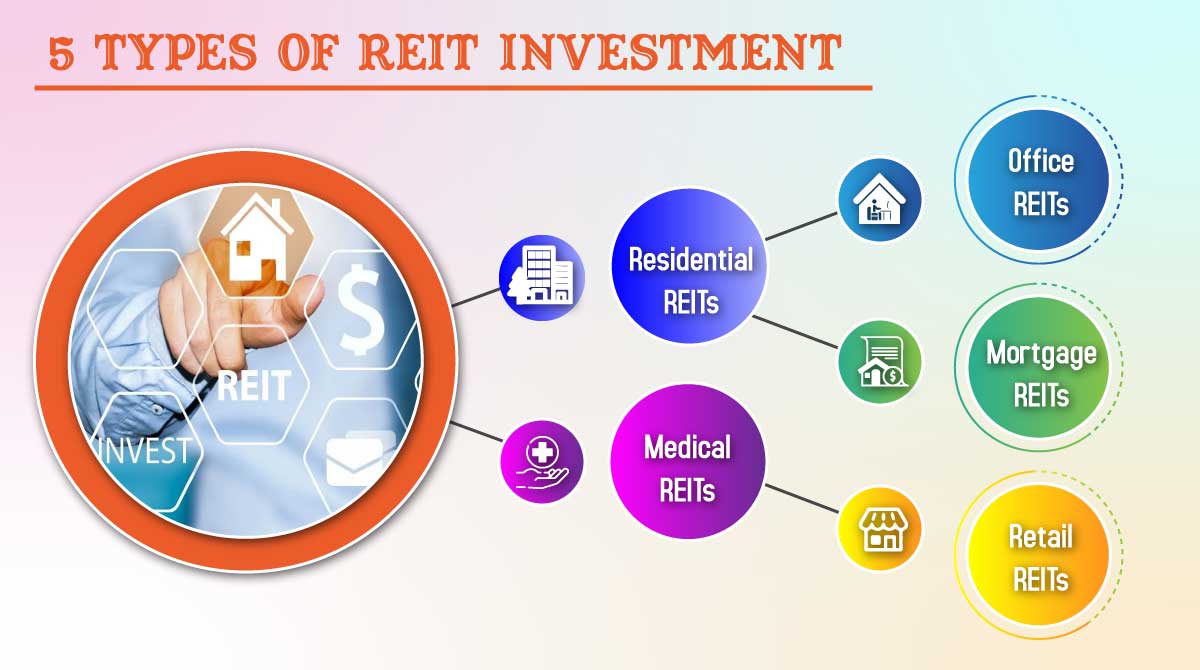

4 Types Of Crowdfunding That Impact Investors

Before making an investment in a crowdfunding campaign, it’s critical to understand the risks and perform your due diligence.

Here is a summary of some kinds of crowdfunding, how they are regulated, and how they affect investors.

1. Equity crowdfunding: The selling of shares to investors through online platforms is known as equity crowdfunding. Equity crowdfunding allows startups as well as small companies to raise funds from a large group of people.

2. Reward-based crowdfunding: A reward-based crowdfunding campaign is utilized to fund creative projects that do not fit into a financial return model such as equity or a fixed return model such as debt or equity loan.

3. Peer-to-peer lending: When one person lends money to some other person or business, this is referred to as peer-to-peer lending. This is not a bank because it isn’t underwritten or backed by the government. It allows people to get lower interest rates on their loans.

4. Fixed investment crowdfunding: This campaign is a type of investment opportunity in which the investor knows exactly how much money they will make and when they will receive it. This is usually done through debt, such as a loan or investment funding.

FAQs

1. Can you crowdfund a property?

Ans: Property crowdfunding is a kind of property investment in which investors earn returns by contributing a portion of the total investment amount.

2. What is a property investment crowdfunding?

Ans: Property crowdfunding is a kind of property investment in which the funds of many shareholders (referred to as “the crowd”) are pooled and used to purchase a home or loaned to development companies as a loan to fund a property development.

3. Is real estate crowdfunding a good idea?

Ans: Whereas real estate crowdfunding and making investments may not be for everyone, it could be a great way to get started in real estate investing without spending a lot of money. When you put less money into an investment, the risk is usually lower.

Should I Invest Into A Crowdfunding Project?

Crowdfunding can be used to fund anything, from cinema to hotels to 3D printers. It is a risky business that requires a lot of coursework, market insight, and intuition on your part, just like alternative investments.

You’ll have to find the works, study them, and keep track of their progress yourself. However, if you’re willing to risk it and make the effort, it can be a satisfying path.

You’ll feel good about continuing to support something you assume in and, hopefully, seeing it grow. If you’ve ever wanted to be a Dragon on Dragons’ Den, crowdfunding may be a good place to start.